Financial results are officially reported in Hong Kong Dollars and are converted here to United States Dollars for easier interpretation.

The Covid-19 pandemic delivered unprecedented challenges around the world in 2020. Economic markets and consumer patterns have created a “new normal”, reshaping the traditional payment market landscape. As countries implemented strict control measures, people have been using less cash, with contactless quickly becoming the preferred consumer method of payment. The payment terminal industry moved into the fast lane, resulting in PAX Technology working more closely than ever before with an even greater number of acquiring banks and payment service providers around the globe.

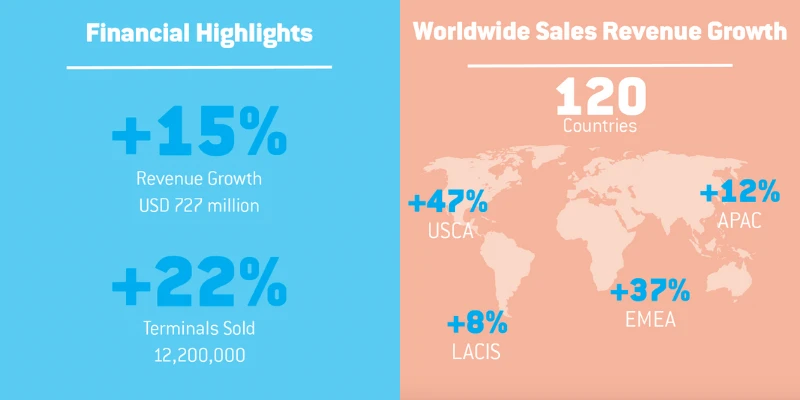

Leveraging its well-established sales network and reputable product portfolio, PAX recorded a 14.7% year-on-year growth in revenue to HKD 5,650.6 million in 2020 (circa USD 727 million). PAX also demonstrated strong enterprise-wide resilience and business competence by growing profits 44.6%. Gross profit margins increased to 41.4% and HKD 460.7 million (over USD 59 million) was ploughed back into product Research & Development.

Basic earnings per share was HKD 0.828 (2019: HKD 0.567), with the Board of Directors recommending to declare a final dividend of HKD 0.10 per ordinary share.

The combination of beautifully designed PAX terminals and the PAXSTORE SaaS platform delivers a unique competitive advantage to payment service providers & their merchants

PAX has been investing heavily in new-generation product development over the past years, a strategy which has been bearing fruit and which, particularly during the challenging year of 2020, has presented surging growth opportunities. The Software-as-a-Service (SaaS) cloud platform known as PAXSTORE continues to be a key success factor behind the popularity of PAX Technology’s wide range of smart Android-based payment terminals. Well over 2 million terminals have been connected to around 150 PAXSTORE marketplaces worldwide, providing merchants with thousands of innovative value-added applications, including ordering, ticketing, membership management, inventory management, marketing, tax refunds, DCC, loyalty, etc. PAXSTORE can optionally be connected to traditional legacy POS terminals as well as other brands of Android devices.

PAX continued to experience robust growth across the EMEA region, with sales revenues increasing 36.8% year-on-year.

Early on during the Covid-19 pandemic, several European countries started to increase their contactless payment limits, with strong demand for Android-based SmartPOS terminals resulting in impressive sales in Italy, the United Kingdom and Greece. During the second half of the year many other markets such as Scandinavia, Eastern Europe, the Iberian peninsula, France and Turkey began to accelerate the deployment of Android terminal solutions.

In the Middle East and Africa, demand began shifting away from traditional PAX devices to the newer Android product range, with strong growth in shipments to Egypt, Nigeria, Saudi Arabia and other Gulf Cooperation Council (GCC) countries. Also during the second half of 2020, PAX increased its market exposure in South Africa, with most of the major acquiring banks there designating PAX as a new supplier.

Revenues grew year-on-year by 46.9% in North America, with sales of the flagship A920 Android SmartPOS model increasing by over 100%, as strategic partnerships with major payment processing companies resulted in greater Android terminal deployment through the extensive network of independent sales organizations (“ISOs”). PAX solutions for multilane retail also continued to be adopted by more & more top-tier retailers and fast-food chains in the USA.

PAX partnered with payment service providers to comply with the April 2021 mandate in the USA to upgrade payment terminals at filling stations to accept EMV transactions, driving further sales growth for the PAX range of unattended products. PAX also partnered with AxiaMed, an industry leader in healthcare payment technology, to provide healthcare institutions with NFC contactless enabled Android payment terminal solutions to handle customer payments in a more hygienic and convenient way.

Revenues grew year-on-year by 8.3% in the region, with Brazil continuing to be a key market for PAX in 2020, where growth is strong for financial technology solutions and next-generation Android-based smart payment terminals. Thanks to strategic local partnerships and its extensive Android product portfolio, PAX remains market leader in Brazil, where significant sales of the A50 and A930 models were achieved during 2020. PAX further expanded its presence in South America with product deployments in Argentina and Mexico.

In the Russia & CIS region, the largest acquirer in the Ukraine partnered with PAX to launch a facial recognition payment service based on the A930 model for authentication, allowing consumers to pay in-store without having to use cash, credit cards or smartphone wallets.

Revenues grew year-on-year by 11.6% across the APAC region. In India, demand for Android payment products continued to grow, where PAX strengthened partnerships with some of the leading acquirers and financial institutions. In Japan, PAX deployed payment terminals in chain convenience stores, theme parks and banking institutions. In Southeast Asia, where electronic payments are flourishing, PAX partnered with leading acquirers and payment service providers to deploy Android-based smart payment solutions in Indonesia, Philippines, Malaysia, Thailand and Vietnam.

“The global electronic payment market is entering a period of rapid growth as consumers ramp up adoption of contactless transactions. Major banks and acquirers around the world are expected to step up their efforts to prepare for the recovery of the retail and hospitality industry, and merchants are accelerating their adoption of Android-based payment terminals to deliver greater business flexibility.

Thanks to our global footprint, PAX will continue to work closely with our reputable payment industry channel partners, acquiring banks, payment service providers and their merchants to explore new potential markets and strengthen PAX’s market share. We will also explore potential M&A projects in the payments sector.

PAX Technology’s payment terminals provide consumers and merchants with a more secure and convenient payment experience. Because of our diversified solutions and extensive sales network, PAX is poised to embrace the huge market opportunities being presented to develop cashless societies.”